Technological innovation drives the development of Bancamiga and the regions

The executive president of Bancamiga, Ariel José Martínez, referred to the opportunities that businessmen, merchants and entrepreneurs have on the island of Margarita to expand and consolidate their businesses

Betting on technological innovation and close customer service, with products and services tailored to their needs, are factors that have contributed to the accelerated growth of Bancamiga in recent years and that this contributes and is reflected in the different regions, points out a statement from the institution.

During the first regional approach that Bancamiga carried out this Tuesday in Porlamar, the executive president of Bancamiga, Ariel José Martínez, stated that the increase in deposits from the general public and the deposits made in foreign currency allowed the bank to position itself among the top five in the private ranking of Venezuelan banking.

In his presentation, he highlighted the increase in the portfolio of accounts and clients, which stood at 729,844 and 346,146, respectively, at the end of December 2021.

With this event held at the Unik Sunsol hotel, Bancamiga Banco Universal offered businessmen, merchants, entrepreneurs and other clients opportunities to consolidate and expand their businesses and operations.

Bancamiga: Second bank with the most points of sale

Martínez also referred to the increase in the gross credit portfolio and celebrated the milestone of exceeding 100,000 points of sale in the market, a figure that makes the bank the second with the largest number of POS.

Bancamiga Points of Sale are the most complete and versatile on the market. They have NFC (contactless) technology and are wireless-WIFI, they work with any operator, encrypted security and touch screen. They also generate a commission for the merchant for each recharge or payment of services that is made and the client receives his liquidation 365 days a year, indicates the informative document.

They also have the advantage of recharging Digitel, Movistar, Movilnet, Inter and Simple TV, paying the Cantv bill, sealing the 5 and 6 and playing El Andinito of the Táchira Lottery. Soon the Corpoelec service can also be canceled with them. And Traders receive a commission between 2% and 5%, for said operations without setbacks.

The rapprochement with businessmen, merchants, entrepreneurs and clients occurs nine months after the Rattan Plaza agency was inaugurated, with which Bancamiga began a process that allowed it to open four agencies in the last quarter of 2021 (Porlamar, Acarigua, Guanare and Maracaibo ) and another four this year (El Tigre, Barquisimeto Este, Puerto Cabello and Coro). Soon another eight will be added to reach 40 by the end of December.

“This state is a development pole for the country due to its great tourism and economic potential. For Bancamiga, its solid presence on the island is fundamental, and it wants to accompany and promote the development of the region,” assured Ariel José Martínez.

He stated that Bancamiga’s growth has been the result of innovating in products and services such as Bancamiga Suite, Apóyame, Exchange Desk and more recently with the launch of the Mastercard Debit Card, the first in Venezuela with Contactless technology.

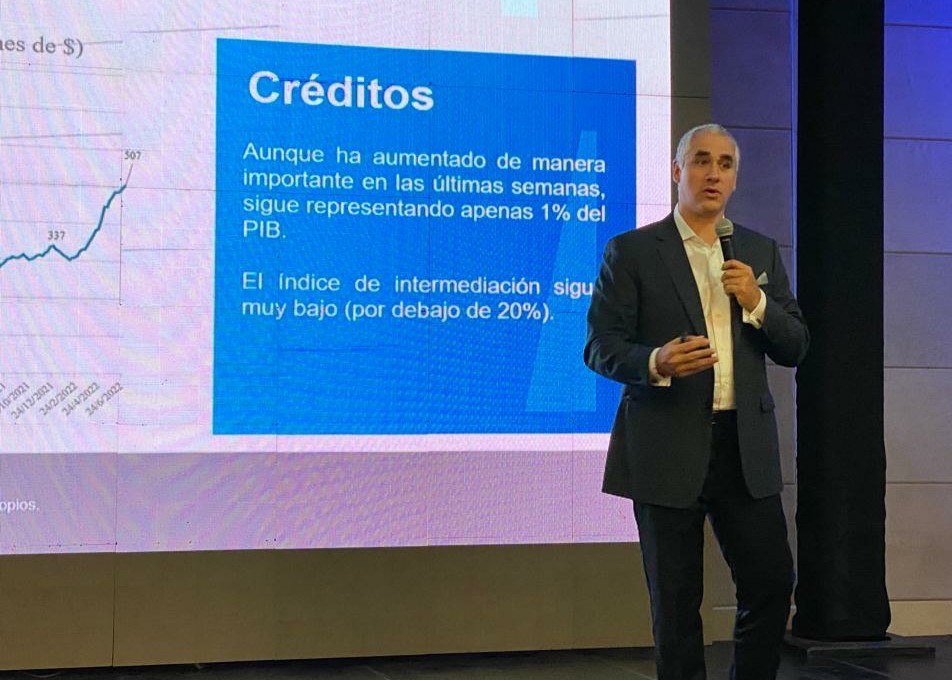

The event included the participation of the economist Luis Oliveros, who spoke about the national and international environment that is presented for companies in this second half of the year.

In his presentation, which was called “Perspectivas económicas para la empresa venezolana”, the speaker offered his recommendations to successfully face the coming months.

With this Tuesday’s meeting, Bancamiga reaffirms the bank’s presence in the region, strongly positions the brand and approaches strategic clients, while ratifying its firm and committed growth alongside the country, the statement concluded.

With information from Bancamiga